Domestic Business

In 2021, the Korean property insurance market suffered large industrial losses arising from a deadly fire at a Coupang warehouse (KRW 360 billion FGU) as well as several mid-sized losses throughout the year. As a result, the loss ratio of the domestic property market shot up even without any notable natural catastrophe event.

Amid high loss ratios, ceding insurers in Korea further lowered their retention levels in 2021. Their average retention ratio had continuously risen from 37.4% in 2015 to 48.8% in 2019 as the market had shown stable performance, with favorable results making the market more competitive. This upward trend reversed in 2020 when insurers experienced a series of large losses, such as fires at Lotte Chemical and LG Chemical. Their retention ratio went down to 46.1% in 2020 and further down to low-to-mid 40% range in 2021. Thus, they have been taking a more cautious approach to capacity deployment and relying more on reinsurance capacity, leading to the hardening of premium rates and the tightening of underwriting guidelines.

Unlike overseas markets, which have been in a hardening cycle for several years now, the Korean property insurance market just started hardening in 2020 when the market loss ratio soared. In 2021, this market hardening trend pushed rates up, especially for large risks which tend to require more reinsurance capacity.

Korean Re also achieved strong growth across all lines of property insurance, backed by the current favorable rating environment and greater dependency of primary insurers on reinsurance. Our domestic property business saw its premium income jump by 14.7% to KRW 605.3 billion in 2021. Gross written premiums from fire insurance grew by 13.0% to KRW 121.3 billion, while premiums from comprehensive insurance increased by 10.4% to KRW 400.2 billion. We also recorded a spike in business from our Korea Interest Abroad (KIA) accounts, with premiums soaring by 44.6% to roughly KRW 84 billion.

Our underwriting performance in domestic property (including KIA) bounced back from a sharp setback in 2020 when we were hit by a number of large losses from man-made disasters like explosions at chemical plants and natural disasters such as Typhoon Maysak. We made a significant improvement in technical profitability, with the combined ratio before management expenses going down by 12.5%p to 91.0% in 2021.

In 2022, market hardening is anticipated to continue, especially with respect to the mega risks which rely more on overseas capacity. Disappointingly, however, we expect premium rates to slightly decrease in small and medium-sized accounts because competition remains high for market shares among primary insurers.

As in previous years, we will continue to resist undercut policies in terms of pricing or ones that do not fit with our underwriting guidelines. In particular, we do not accept any policies that are based on so-called “judgement rates” in our inward treaties as they do not meet our underwriting guidelines. A judgement rate is one that primary insurers produce themselves by using their own statistics, and it is usually utilized for small and medium-sized accounts when a primary insurer intends to retain most or all of the risks with its own capacity.

For treaty renewals in 2022, we have strictly maintained our underwriting discipline by restricting reinsurance terms and conditions and reducing cession ranges and commission rates, as well as minimizing exposure to risks that are sensitive to economic downturns, including warehouse and factory fire policies. As we focus on building a profit-oriented portfolio, we will continue to take a highly disciplined approach to underwriting and remain selective about risk acceptance and pricing.

In 2021, the Korean property insurance market suffered large industrial losses arising from a deadly fire at a Coupang warehouse (KRW 360 billion FGU) as well as several mid-sized losses throughout the year. As a result, the loss ratio of the domestic property market shot up even without any notable natural catastrophe event.

Amid high loss ratios, ceding insurers in Korea further lowered their retention levels in 2021. Their average retention ratio had continuously risen from 37.4% in 2015 to 48.8% in 2019 as the market had shown stable performance, with favorable results making the market more competitive. This upward trend reversed in 2020 when insurers experienced a series of large losses, such as fires at Lotte Chemical and LG Chemical. Their retention ratio went down to 46.1% in 2020 and further down to low-to-mid 40% range in 2021. Thus, they have been taking a more cautious approach to capacity deployment and relying more on reinsurance capacity, leading to the hardening of premium rates and the tightening of underwriting guidelines.

Unlike overseas markets, which have been in a hardening cycle for several years now, the Korean property insurance market just started hardening in 2020 when the market loss ratio soared. In 2021, this market hardening trend pushed rates up, especially for large risks which tend to require more reinsurance capacity.

Korean Re also achieved strong growth across all lines of property insurance, backed by the current favorable rating environment and greater dependency of primary insurers on reinsurance. Our domestic property business saw its premium income jump by 14.7% to KRW 605.3 billion in 2021. Gross written premiums from fire insurance grew by 13.0% to KRW 121.3 billion, while premiums from comprehensive insurance increased by 10.4% to KRW 400.2 billion. We also recorded a spike in business from our Korea Interest Abroad (KIA) accounts, with premiums soaring by 44.6% to roughly KRW 84 billion.

Our underwriting performance in domestic property (including KIA) bounced back from a sharp setback in 2020 when we were hit by a number of large losses from man-made disasters like explosions at chemical plants and natural disasters such as Typhoon Maysak. We made a significant improvement in technical profitability, with the combined ratio before management expenses going down by 12.5%p to 91.0% in 2021.

In 2022, market hardening is anticipated to continue, especially with respect to the mega risks which rely more on overseas capacity. Disappointingly, however, we expect premium rates to slightly decrease in small and medium-sized accounts because competition remains high for market shares among primary insurers.

As in previous years, we will continue to resist undercut policies in terms of pricing or ones that do not fit with our underwriting guidelines. In particular, we do not accept any policies that are based on so-called “judgement rates” in our inward treaties as they do not meet our underwriting guidelines. A judgement rate is one that primary insurers produce themselves by using their own statistics, and it is usually utilized for small and medium-sized accounts when a primary insurer intends to retain most or all of the risks with its own capacity.

For treaty renewals in 2022, we have strictly maintained our underwriting discipline by restricting reinsurance terms and conditions and reducing cession ranges and commission rates, as well as minimizing exposure to risks that are sensitive to economic downturns, including warehouse and factory fire policies. As we focus on building a profit-oriented portfolio, we will continue to take a highly disciplined approach to underwriting and remain selective about risk acceptance and pricing.

Gross Written Premiums: Domestic Property Business

(Units: KRW billion, USD million)

| FY 2021 (KRW) | FY 2021 (USD) | FY 2020 (KRW) | FY 2020 (USD) | |

| Fire | 121.3 | 105.5 | 107.3 | 90.0 |

| Comprehensive | 400.2 | 348.2 | 362.5 | 304.2 |

| Korea Interest Abroad (KIA) | 83.8 | 72.9 | 58.0 | 403.4 |

| Total | 605.3 | 526.6 | 527.7 | 442.8 |

✽ Individual figures may not add up to the total shown due to rounding.

International Facultative Business

For several years in a row, we achieved double-digit growth in our international property facultative business, with gross written premiums increasing by 11.4% to KRW 137.6 billion in 2021. Our underwriting profitability remained fairly encouraging, and the combined ratio before management expenses stood at 73.0% in 2021.

We pride ourselves on the profitable growth we have delivered over the last few years based on our strategic efforts to take customized approaches to underwriting for different regions. We have also continuously tightened our underwriting guidelines to minimize exposure in catastrophe-prone areas.

A hardening phase in the insurance market cycle has been sustained, allowing for a continuously favorable pricing environment. For Power and Onshore Energy risks in particular, we saw our gross written premiums increase robustly from the previous year due to hardening market conditions as well as the rate increasing trend. Taking advantage of the positive market conditions, we have increased our participation in proportional reinsurance programs with strong track records of profitability.

The portfolio restructuring that we have sought over the past years also helped us maintain a solid growth trajectory.

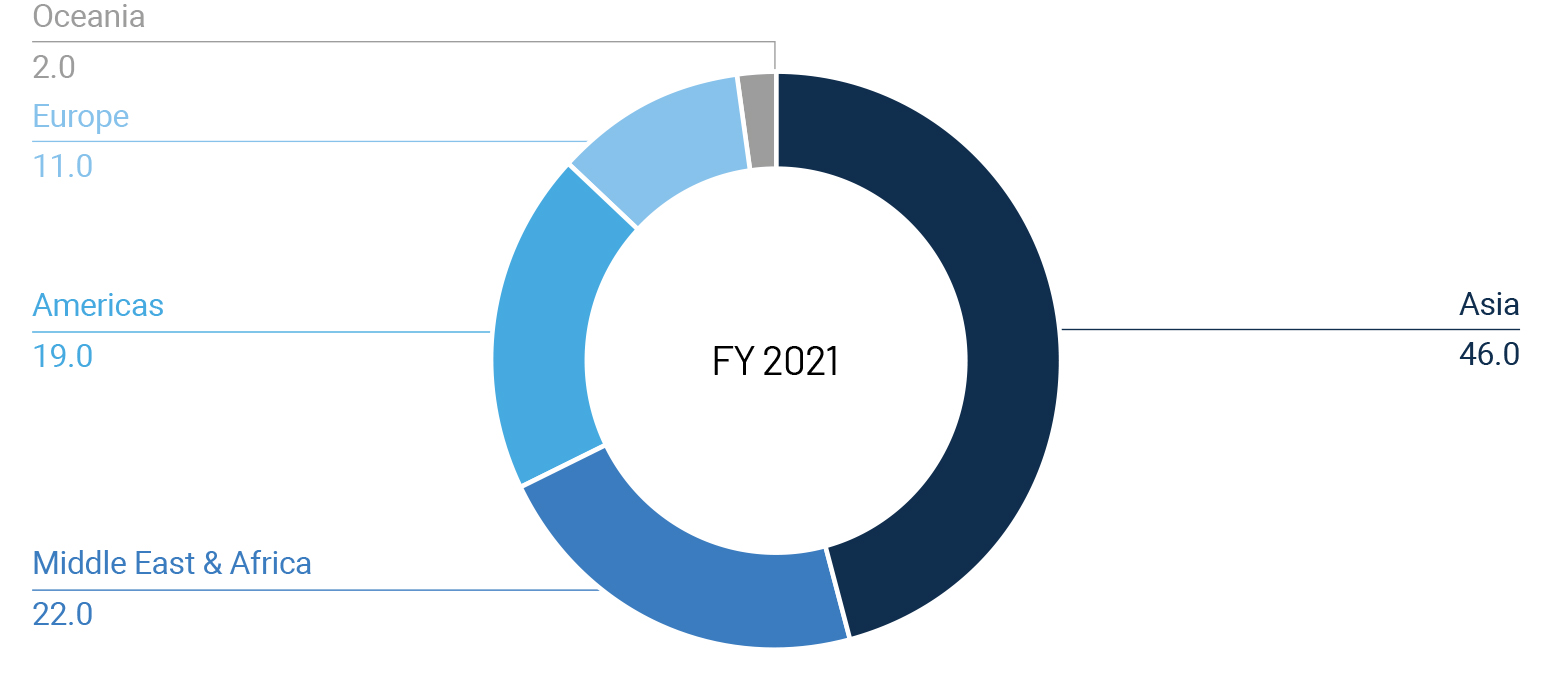

Although Asia remains dominant in our business portfolio, we have strived to expand into new markets and further diversify our portfolio geographically. The expansion of business has been backed by rigorous risk assessment, which enables us to identify the target markets that provide profitable growth opportunities. In terms of premium breakdown by territory, Asia took up the largest share (46%) of our entire international property facultative portfolio in 2021, followed by the Middle East & Africa (22%), the Americas (19%), and Europe (11%).

As we enter 2022, we look forward with confidence to the opportunities that the year will bring. The current firming of the reinsurance market will likely persist throughout 2022, and favorable pricing momentum will have a positive impact on both business growth and underwriting margins. Still, we may face some headwinds related to the pandemic, regulatory developments, and catastrophe losses. In other words, the path ahead may not be necessarily an easy one to navigate, but we will remain committed to supporting our clients on the back of our strong credit ratings and capacity on top of our underwriting expertise and experience. These are the very strengths that have been at the core of our business success and that will remain the bedrock of our long-term growth.

For several years in a row, we achieved double-digit growth in our international property facultative business, with gross written premiums increasing by 11.4% to KRW 137.6 billion in 2021. Our underwriting profitability remained fairly encouraging, and the combined ratio before management expenses stood at 73.0% in 2021.

We pride ourselves on the profitable growth we have delivered over the last few years based on our strategic efforts to take customized approaches to underwriting for different regions. We have also continuously tightened our underwriting guidelines to minimize exposure in catastrophe-prone areas.

A hardening phase in the insurance market cycle has been sustained, allowing for a continuously favorable pricing environment. For Power and Onshore Energy risks in particular, we saw our gross written premiums increase robustly from the previous year due to hardening market conditions as well as the rate increasing trend. Taking advantage of the positive market conditions, we have increased our participation in proportional reinsurance programs with strong track records of profitability.

The portfolio restructuring that we have sought over the past years also helped us maintain a solid growth trajectory. Although Asia remains dominant in our business portfolio, we have strived to expand into new markets and further diversify our portfolio geographically. The expansion of business has been backed by rigorous risk assessment, which enables us to identify the target markets that provide profitable growth opportunities. In terms of premium breakdown by territory, Asia took up the largest share (46%) of our entire international property facultative portfolio in 2021, followed by the Middle East & Africa (22%), the Americas (19%), and Europe (11%).

As we enter 2022, we look forward with confidence to the opportunities that the year will bring. The current firming of the reinsurance market will likely persist throughout 2022, and favorable pricing momentum will have a positive impact on both business growth and underwriting margins. Still, we may face some headwinds related to the pandemic, regulatory developments, and catastrophe losses. In other words, the path ahead may not be necessarily an easy one to navigate, but we will remain committed to supporting our clients on the back of our strong credit ratings and capacity on top of our underwriting expertise and experience. These are the very strengths that have been at the core of our business success and that will remain the bedrock of our long-term growth.

International Facultative Portfolio by Geography

(Unit: %)

Gross Written Premiums: International Facultative Business

(Units: KRW billion, USD million)

| FY 2021 (KRW) | FY 2021 (USD) | FY 2020 (KRW) | FY 2020 (USD) | |

| International Facultative | 137.6 | 119.7 | 123.5 | 103.6 |

International Treaty Business

It was another challenging year in 2021 for reinsurers as we saw an array of extreme weather events all over the world, most notably in the United States and Europe. Hurricane Ida, which made landfall in Louisiana in late August, resulted in a loss of USD 36 billion, one of the highest individual losses ever for insurers. Historic rainfall and flooding occurred in Western and Central Europe in July, generating insured losses of USD 13 billion. Total insured losses from natural disasters reached USD 130 billion in 2021, making it the fourth costliest year on record for public and private insurance entities, only behind 2017, 2011, and 2005. It was also marked as a year of huge losses from secondary perils such as floods, convective storms, and winter freeze.

The reinsurance market presented a mixed picture at the January 2022 renewals. While lines of business with heightened losses in 2021 have continued to see significant price increases, loss-free lines of business attracted additional capital, causing prices to stay stationary. Traditional and alternative reinsurance capital steadily increased during 2021 despite heavy losses caused by natural catastrophes.

In 2021, our international treaty business written by the head office saw a 7.5% decrease in gross written premiums, which totaled KRW 497.4 billion. The decrease was mainly driven by the transfer of the Chinese business to our Shanghai branch. However, we successfully achieved our target premium volume by adding new accounts in Europe and the U.S. and securing solid market growth in the Middle East.

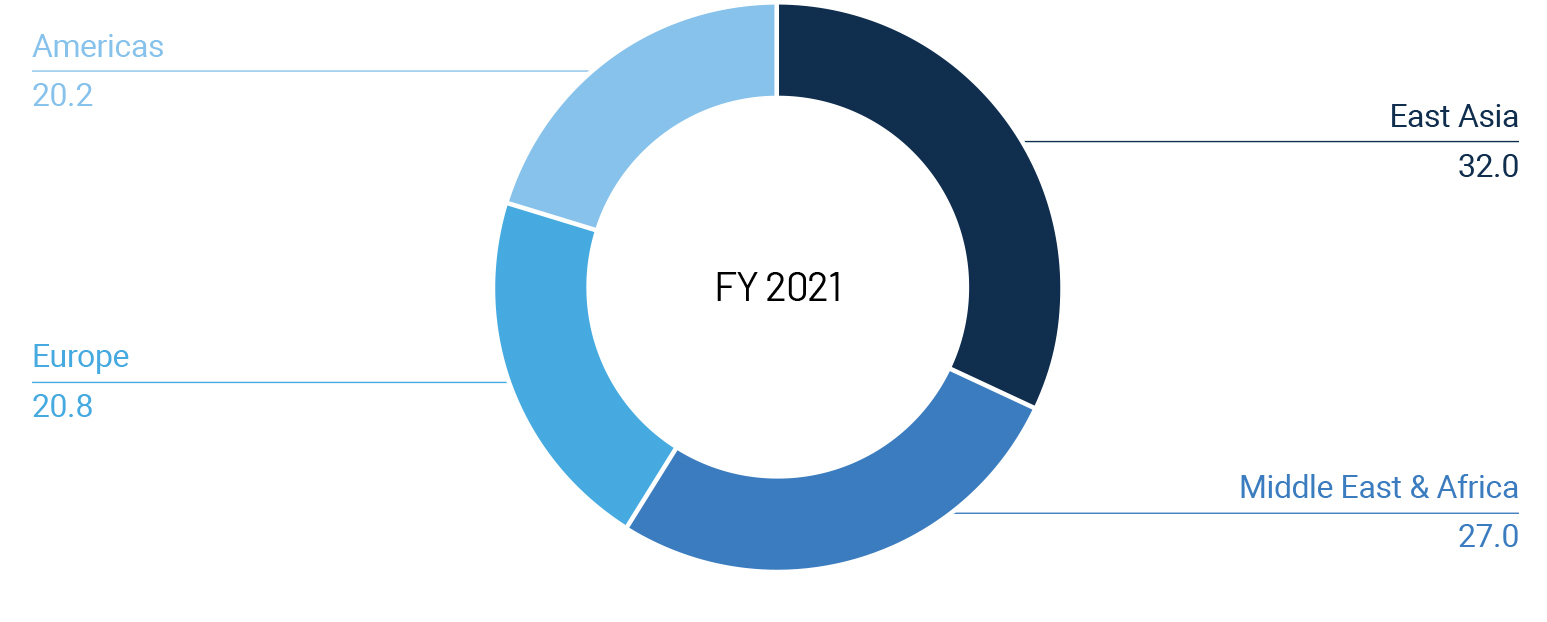

In terms of portfolio management, we continued our efforts to optimize our business portfolio by region so as to withstand the volatility of catastrophe and large risk losses. The share of East Asia decreased, but it still made up the largest portion of our international treaty portfolio at 32.0%, followed by the Middle East & Africa at 27.0%, Europe at 20.8%, and the Americas at 20.2%.

Although we will have to keep dealing with the uncertainty of COVID-19 losses and the impact of natural disasters, we will stick to our current underwriting strategy, which is aimed at achieving sustainable growth in target regions. At the same time, we will strive to reduce loss volatility arising from global climate change and regional business environment changes through various risk transfer options available in the alternative capital market as well as the traditional reinsurance market.

It was another challenging year in 2021 for reinsurers as we saw an array of extreme weather events all over the world, most notably in the United States and Europe. Hurricane Ida, which made landfall in Louisiana in late August, resulted in a loss of USD 36 billion, one of the highest individual losses ever for insurers. Historic rainfall and flooding occurred in Western and Central Europe in July, generating insured losses of USD 13 billion. Total insured losses from natural disasters reached USD 130 billion in 2021, making it the fourth costliest year on record for public and private insurance entities, only behind 2017, 2011, and 2005. It was also marked as a year of huge losses from secondary perils such as floods, convective storms, and winter freeze.

The reinsurance market presented a mixed picture at the January 2022 renewals. While lines of business with heightened losses in 2021 have continued to see significant price increases, loss-free lines of business attracted additional capital, causing prices to stay stationary. Traditional and alternative reinsurance capital steadily increased during 2021 despite heavy losses caused by natural catastrophes.

In 2021, our international treaty business written by the head office saw a 7.5% decrease in gross written premiums, which totaled KRW 497.4 billion. The decrease was mainly driven by the transfer of the Chinese business to our Shanghai branch. However, we successfully achieved our target premium volume by adding new accounts in Europe and the U.S. and securing solid market growth in the Middle East.

In terms of portfolio management, we continued our efforts to optimize our business portfolio by region so as to withstand the volatility of catastrophe and large risk losses. The share of East Asia decreased, but it still made up the largest portion of our international treaty portfolio at 32.0%, followed by the Middle East & Africa at 27.0%, Europe at 20.8%, and the Americas at 20.2%.

Although we will have to keep dealing with the uncertainty of COVID-19 losses and the impact of natural disasters, we will stick to our current underwriting strategy, which is aimed at achieving sustainable growth in target regions. At the same time, we will strive to reduce loss volatility arising from global climate change and regional business environment changes through various risk transfer options available in the alternative capital market as well as the traditional reinsurance market.

Gross Written Premiums: International Treaty Business

(Units: KRW billion, USD million)

| FY 2021 (KRW) | FY 2021 (USD) | FY 2020 (KRW) | FY 2020 (USD) | |

| East Asia | 159.1 | 138.4 | 211.9 | 177.8 |

| Middle East & Africa | 134.4 | 116.9 | 124.0 | 104.1 |

| Europe | 103.3 | 89.9 | 96.9 | 81.3 |

| Americas | 100.6 | 87.5 | 104.8 | 87.9 |

| Total | 497.4 | 432.7 | 537.6 | 451.1 |

International Treaty Portfolio by Geography

(Unit: %)