In Korea, nuclear risks are insured by the Korea Atomic Energy Insurance Pool (KAEIP), which is managed by Korean Re. KAEIP is a voluntary, unincorporated association of 12 non-life insurance and reinsurance companies. On behalf of its members, we support the operation of KAEIP based on our expertise in risk management and underwriting so that the pool can provide risk transfer solutions to the nuclear industry that would otherwise be unable to obtain insurance coverage. The pool jointly underwrites nuclear risks domestically, which are then shared internationally via reciprocation with other nuclear insurance pools across the world.

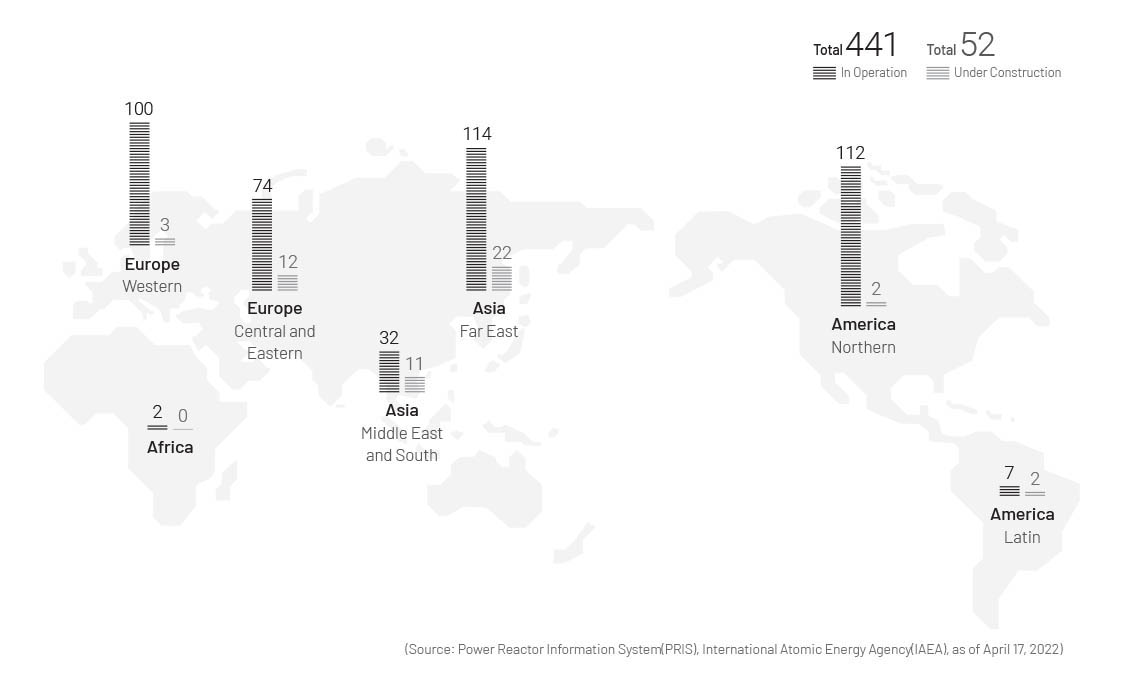

There are 26 nuclear power plants (NPPs) in Korea, with 24 NPPs in operation and two NPPs permanently shut down (Kori Unit 1 in June 2017 and Wolsong Unit 1 in December 2019). At present, one unit is under review for commercial operation, and three additional units are under construction. Globally, a total of 439 reactors are commercially operational, and 52 reactors are currently being built. Major countries with nuclear reactors under construction are China (14 units), India (6 units), and the UAE, Russia and Turkey (3 units each).

In 2021, KAEIP achieved growth both in domestic direct and international reinsurance premiums. It wrote domestic direct premiums of KRW 35.7 billion in 2021, up modestly from the previous year, while its overseas inward reinsurance premiums increased by over 15% to KRW 19.2 billion.

The domestic direct business is expected to grow in line with the ongoing construction of nuclear reactors. Internationally, demand for reinsurance capacity in the nuclear insurance market is expected to increase as the Protocols to Amend the Paris Convention on Nuclear Third Party Liability, one of the international treaties on nuclear liability, entered into force as of January 1, 2022, and will allow greater compensation for those who suffer losses resulting from an accident in the nuclear energy sector. This is likely to drive premium growth in our overseas nuclear business for the next few years.

There has been a slight increase in nuclear insurance premium rates in some countries due to the impact of overall market hardening in the global insurance industry. This upward rating momentum may be sustained further, considering that market conditions still remain firm.

As a provider of specialist insurance coverage for the nuclear industry, KAEIP will remain committed to supporting nuclear operators in terms of insurance capacity and risk management services. In addition to ensuring that stable insurance capacity is provided domestically, it will also keep exploring new growth opportunities across the globe by staying responsive to market dynamics. Korean Re will play a leading role in these endeavors by KAEIP.

Gross Written Premiums: Korea Atomic Energy Insurance Pool (KAEIP)

(Units: KRW billion, USD million)

| FY 2021 (KRW) | FY 2021 (USD) | FY 2020 (KRW) | FY 2020 (USD) | |

| Domestic Direct | 35.7 | 31.1 | 34.4 | 28.9 |

| Overseas Reinsurance Inward | 19.2 | 16.7 | 16.6 | 13.9 |

| Total | 54.9 | 47.8 | 51.0 | 42.8 |

Global Reactor Status by Region