Domestic Business

In 2021, we had a challenging year in terms of both growth and profitability. We saw our domestic life and health (L&H) premiums decrease by 7.4% to KRW 856.8 billion in 2021 as we pursued strategic portfolio adjustments by reducing loss-making or low-margin contracts. Our underwriting profit fell by KRW 8 billion to KRW 17.9 billion due to a one-off rise in large losses and an increase in the loss ratios of cancer and medical expense insurance.

The decline in our top-line growth was directly linked to the slowing trend of the primary life insurance market in Korea. Domestic life premium growth slowed to 4.3% in 2021, with total premiums reaching KRW 124.8 trillion, according to the estimates released by the Korea Insurance Research Institute. The growth of protection life insurance weakened to 2.8% in 2021, compared to an increase of 3.8% in 2020. This slowdown in growth reflected growing concerns over mis-selling of certain products newly launched by insurers and tighter regulation of insurance sales commission schemes. Savings-type insurance managed to grow by 1% amid rising gaps between interest rates on bank deposits and crediting rates on insurance products. Market interest rates stayed mostly below 1% during 2021, while insurance companies’ rates remained in the 2% range, which made savings-type insurance more attractive.

The Korean life reinsurance market also stagnated, with reinsurance premiums falling by 1.7% to an estimate of KRW 2,191.1 billion in 2021 from KRW 2,228.8 billion in 2020. Still, Korean Re was able to maintain its market share at around 40% in 2021 on the back of our ongoing initiatives to collaborate with direct insurers to develop new products.

Looking forward to 2022, the pace of market growth is expected to remain slow, with life premiums increasing by 1.7% to KRW 126.9 trillion. This is in part because insurers are less motivated to develop new products as a result of the strengthened supervision of mis-selling practices. In spite of slowing growth in overall life premiums, protection insurance is expected to grow by 2.7% on the back of rising demand for health insurance products.

General savings insurance is expected to grow by 2.8% as a large number of savings policies come into maturity in 2022, and some of the policyholders who receive maturity benefits are expected to buy new savings insurance. Back in 2012, there was a rush to buy general savings insurance before the tax changes that became effective in 2013, resulting in a spike in savings insurance premiums in 2012.

All in all, there are some reasons to be hopeful for a brighter year ahead. We believe business conditions for face-to-face sales channels will improve as social distancing is gradually being eased amid a rising vaccination rate. Reduced economic uncertainty, a recovery in the real economy, and rising interest rates will combine together to boost demand for both personal and commercial insurance.

There are still factors that may have negative effects on insurance demand growth, such as a decrease in precautionary savings, a slowdown in liquidity expansion, and soaring household debt. The greatest uncertainty for 2022 may well be about when the COVID-19 pandemic will end or whether it will ever go away.

Although much of what lies ahead remains uncertain, Korean Re will certainly remain stable in providing reinsurance capacity. We will continue to actively support domestic life insurers by offering high-quality technical services to their underwriters. We will also strengthen our expertise in providing clients with risk management solutions, including newly introduced coinsurance arrangements, and support them under the upcoming IFRS 17 regime.

In addition, portfolio reorganization will be our key task in 2022. We will hold onto profit-oriented underwriting built around comprehensive product analysis and strong risk management so that we can improve the profitability of our overall business.

In 2021, we had a challenging year in terms of both growth and profitability. We saw our domestic life and health (L&H) premiums decrease by 7.4% to KRW 856.8 billion in 2021 as we pursued strategic portfolio adjustments by reducing loss-making or low-margin contracts. Our underwriting profit fell by KRW 8 billion to KRW 17.9 billion due to a one-off rise in large losses and an increase in the loss ratios of cancer and medical expense insurance.

The decline in our top-line growth was directly linked to the slowing trend of the primary life insurance market in Korea. Domestic life premium growth slowed to 4.3% in 2021, with total premiums reaching KRW 124.8 trillion, according to the estimates released by the Korea Insurance Research Institute. The growth of protection life insurance weakened to 2.8% in 2021, compared to an increase of 3.8% in 2020. This slowdown in growth reflected growing concerns over mis-selling of certain products newly launched by insurers and tighter regulation of insurance sales commission schemes. Savings-type insurance managed to grow by 1% amid rising gaps between interest rates on bank deposits and crediting rates on insurance products. Market interest rates stayed mostly below 1% during 2021, while insurance companies’ rates remained in the 2% range, which made savings-type insurance more attractive.

The Korean life reinsurance market also stagnated, with reinsurance premiums falling by 1.7% to an estimate of KRW 2,191.1 billion in 2021 from KRW 2,228.8 billion in 2020. Still, Korean Re was able to maintain its market share at around 40% in 2021 on the back of our ongoing initiatives to collaborate with direct insurers to develop new products.

Looking forward to 2022, the pace of market growth is expected to remain slow, with life premiums increasing by 1.7% to KRW 126.9 trillion. This is in part because insurers are less motivated to develop new products as a result of the strengthened supervision of mis-selling practices. In spite of slowing growth in overall life premiums, protection insurance is expected to grow by 2.7% on the back of rising demand for health insurance products. General savings insurance is expected to grow by 2.8% as a large number of savings policies come into maturity in 2022, and some of the policyholders who receive maturity benefits are expected to buy new savings insurance. Back in 2012, there was a rush to buy general savings insurance before the tax changes that became effective in 2013, resulting in a spike in savings insurance premiums in 2012.

All in all, there are some reasons to be hopeful for a brighter year ahead. We believe business conditions for face-to-face sales channels will improve as social distancing is gradually being eased amid a rising vaccination rate. Reduced economic uncertainty, a recovery in the real economy, and rising interest rates will combine together to boost demand for both personal and commercial insurance.

There are still factors that may have negative effects on insurance demand growth, such as a decrease in precautionary savings, a slowdown in liquidity expansion, and soaring household debt. The greatest uncertainty for 2022 may well be about when the COVID-19 pandemic will end or whether it will ever go away.

Although much of what lies ahead remains uncertain, Korean Re will certainly remain stable in providing reinsurance capacity. We will continue to actively support domestic life insurers by offering high-quality technical services to their underwriters. We will also strengthen our expertise in providing clients with risk management solutions, including newly introduced coinsurance arrangements, and support them under the upcoming IFRS 17 regime.

In addition, portfolio reorganization will be our key task in 2022. We will hold onto profit-oriented underwriting built around comprehensive product analysis and strong risk management so that we can improve the profitability of our overall business.

Gross Written Premiums: Domestic Life and Health

(Units: KRW billion, USD million)

| FY 2021 (KRW) | FY 2021 (USD) | FY 2020 (KRW) | FY 2020 (USD) | |

| Domestic Life and Health | 856.8 | 745.4 | 925.0 | 776.2 |

Overseas Business

In 2021, the global life reinsurance market continued to struggle with the impact of COVID-19 as the pandemic stubbornly dragged on. Notably, the mortality rate in the U.S. increased significantly due to COVID-19, and it may take some time for the mortality rate to go through downward stabilization and return to its average level. In the face of the uncertainty caused by the pandemic, life reinsurers have been making all-out efforts to minimize the negative impact arising from the current unprecedented circumstances based on the diversification of financial strategies and flexible underwriting operations.

Korean Re also wrestled with challenges in 2021. Most importantly, we made strategic portfolio adjustments by withdrawing from treaties with low margins and avoiding poorly performing contracts. As a result, our overseas L&H business saw its gross written premiums fall 16.4% year-on-year to KRW 452.4 billion. Over the course of the year, our underwriting profitability also deteriorated significantly due to COVID-19 losses.

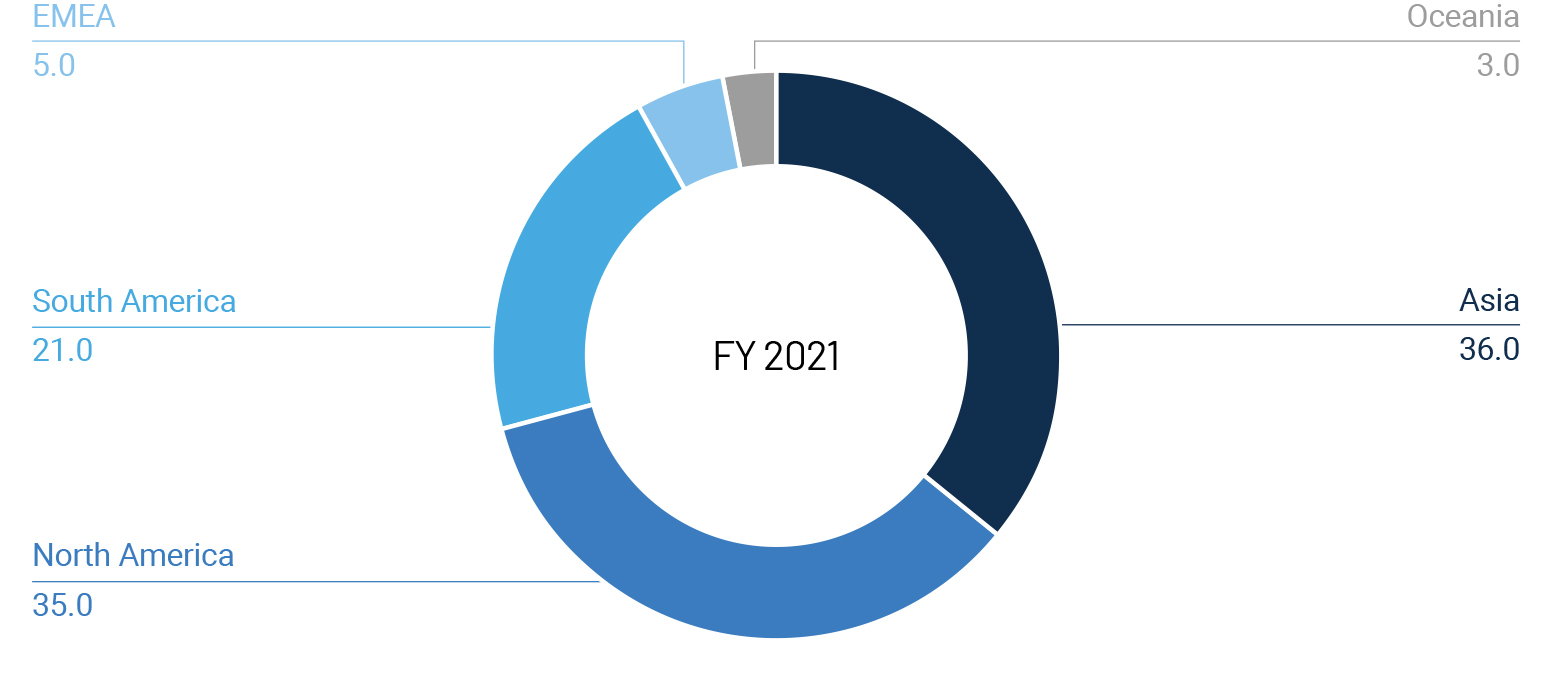

Moreover, we continued our efforts to build a geographically balanced portfolio. Asia accounted for 36% of our entire overseas L&H portfolio, with China taking up 21% of the Asian business. North and South Americas made up 35% and 21%, respectively, while EMEA and Oceania remained small at 5% and 3%, respectively.

Looking ahead to 2022, the business environment is expected to remain persistently harsh, especially because of the ongoing emergence of COVID-19 losses. We will put all our capabilities into the recovery of profitability and make that our top priority. To this end, we will increase the proportion of short-term businesses such as group treaties and non-proportional treaties, and continue to promote regional diversification in advanced markets.

At the same time, it is imperative that we focus on increasing our market share by actively utilizing Korean Re’s business networks in our flagship markets, such as China and North America. We will strengthen our relationships with existing clients, while also seeking strategic business alliances with new companies.

We at Korean Re clearly understand the role that we need to play in helping our clients optimize their risk-based capital in a way that helps them meet their regulatory requirements and ensure their business growth. We are committed to living up to that role, which in turn may provide new business expansion opportunities for our company. Considering that evolving regulations continue to drive demand for non-traditional reinsurance, we believe it is now more important than ever that we dedicate ourselves to offering innovative solutions that can help reduce the required capital of insurers as well as help boost our business growth.

International Portfolio by Geography

(Unit: %)

Gross Written Premiums: Overseas Life and Health

(Units: KRW billion, USD million)

| FY 2021 (KRW) | FY 2021 (USD) | FY 2020 (KRW) | FY 2020 (USD) | |

| Asia | 162.3 | 141.2 | 200.8 | 168.5 |

| Americas & Oceania | 266.6 | 231.9 | 307.7 | 258.2 |

| Europe, Middle East, and Africa (EMEA) | 23.5 | 20.5 | 32.7 | 27.4 |

| Total | 452.4 | 393.6 | 541.2 | 454.1 |